When it comes to estate planning, I hear the same advice repeated over and over: “Just add your kids to the deed now. It’ll make things easier when you’re gone.”

As a real estate agent who’s worked with families throughout the Dayton area for years, I understand the appeal. You want to avoid probate. You want to spare your children the hassle of dealing with courts and legal processes during an already difficult time. Your intentions are good.

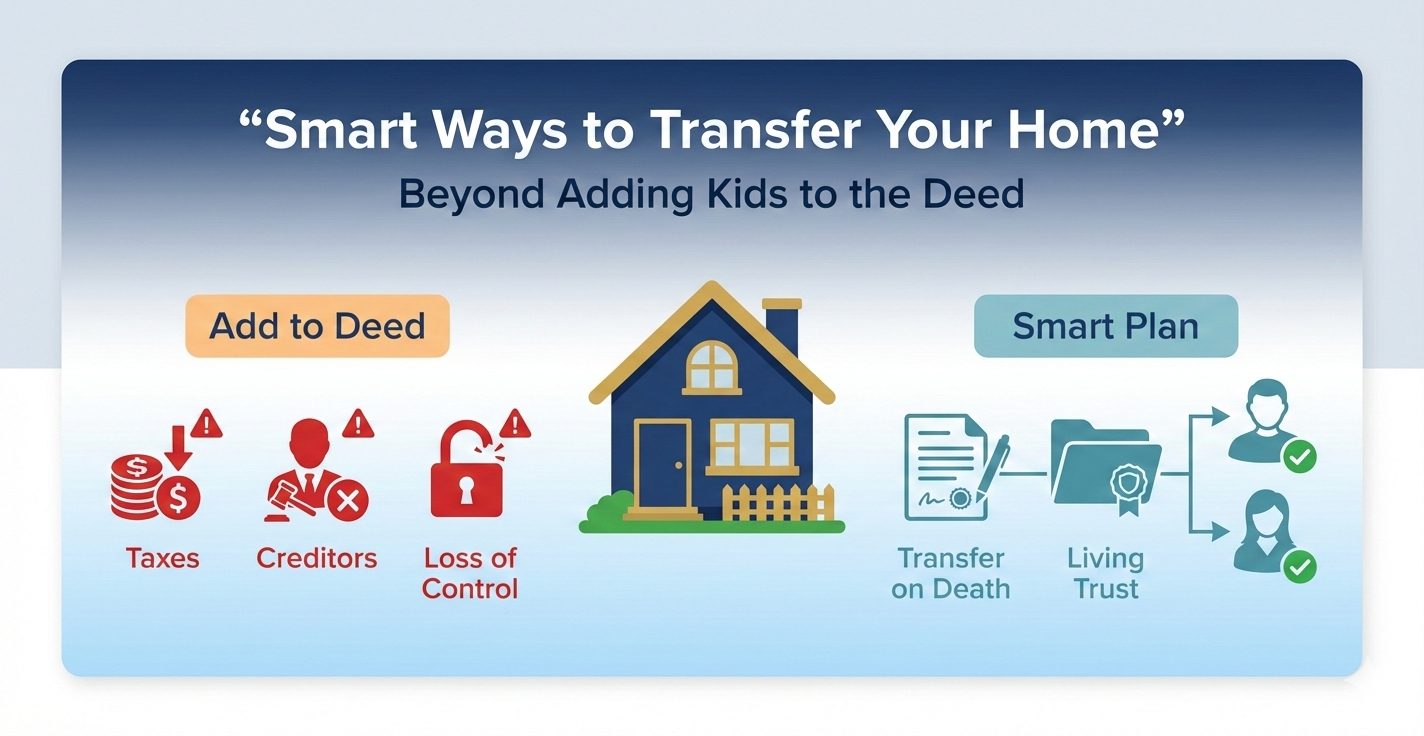

But here’s what I’ve learned from watching families navigate this decision: adding your children to your home’s deed while you’re still living is rarely the right move. In fact, it often creates far more problems than it solves—problems that can cost your children tens of thousands of dollars and put your home at risk.

The good news? There are better alternatives that accomplish your goals without the downsides. Let me walk you through what you need to know.

Why Adding Children to Your Deed Usually Backfires

When you add your child’s name to your deed, you’re not just planning for the future—you’re giving them partial ownership of your home right now. And that changes everything.

The Tax Hit Your Children Will Take

This is the big one, and it’s the consequence most families don’t see coming.

When you add your child to your deed during your lifetime, they lose what’s called the “stepped-up basis” for tax purposes. Instead of inheriting the home at its current market value, they inherit your original purchase price as their cost basis. When they eventually sell the property, they’ll pay capital gains taxes on decades of appreciation.

Let me show you what this looks like with real numbers:

You bought your home in Springboro in 1995 for $100,000. Today, it’s worth $350,000. That’s $250,000 in appreciation over the years.

Scenario 1: You add your child to the deed now

- Their cost basis: $100,000 (your original purchase price)

- They sell for $360,000

- Taxable gain: $260,000

- Estimated tax bill: $39,000 – $62,400 (depending on their tax bracket and how long they hold it)

Scenario 2: Your child inherits the property at your death

- Their cost basis: $350,000 (the value when they inherited it—the “stepped-up basis”)

- They sell for $360,000

- Taxable gain: $10,000

- Estimated tax bill: $1,500 – $2,400

By trying to make things “easier,” you could be costing your child $40,000 to $60,000 in unnecessary taxes. That’s a hefty price for avoiding probate.

Your Home Becomes Vulnerable to Your Child’s Problems

Once your child is on the deed, your home is no longer protected from their financial and legal issues.

If your child:

- Gets sued

- Goes through a divorce

- Faces bankruptcy

- Has creditors pursuing them

- Gets into a serious car accident and is found liable

Your home could be at risk. Even though you’re still living there and paying the mortgage, your child’s ownership interest makes the property vulnerable to their creditors and legal judgments.

I’ve seen families lose homes they’d owned for decades because of a child’s unexpected financial crisis. It’s heartbreaking, and it’s avoidable.

Gift Tax Reporting Requirements

The IRS considers adding a child to your deed a gift. While you probably won’t owe gift tax (the lifetime exemption is quite high), you’ll need to file a gift tax return. This counts against your lifetime gift tax exemption, which could matter if you have a substantial estate.

More paperwork, more complexity, and potential estate tax implications you might not have considered.

You Lose Control of Your Own Home

This might be the most frustrating consequence of all.

Once your child is on the deed, you can’t sell or refinance your home without their permission and signature. Need to downsize? Want to do a reverse mortgage? Thinking about selling and moving closer to family?

You’ll need your child’s cooperation for every decision.

And if your child:

- Is going through a divorce (and their spouse needs to sign off too)

- Lives out of state and is difficult to reach

- Has their own financial problems

- Disagrees with your decision

You could find yourself stuck in your own home, unable to make decisions about your most valuable asset.

Better Alternatives for Ohio Homeowners

Fortunately, you don’t have to choose between adding children to your deed and leaving your family to deal with probate. Ohio law provides two excellent alternatives, and the right choice depends on your overall situation.

Option 1: Transfer on Death (TOD) Designation

Ohio’s Transfer on Death designation, also called a beneficiary deed, is an elegant solution for straightforward situations.

How It Works:

You file a simple document with your county recorder’s office designating who should receive your home when you pass away. That’s it. You maintain 100% ownership and control during your lifetime.

You can:

- Sell your home anytime without anyone’s permission

- Refinance whenever you want

- Change or revoke the designation at any time

- Name multiple beneficiaries if you choose

- Rest easy knowing you maintain complete control

When you pass away, the property transfers automatically to your designated beneficiaries without going through probate.

The Benefits:

- You keep complete control – It’s your home until the day you die

- Avoids probate – Your beneficiaries don’t deal with court proceedings

- Preserves stepped-up basis – Your children get the tax benefit

- Protects your home – The property isn’t vulnerable to your children’s creditors or legal problems during your lifetime

- Simple and affordable – Usually costs $100-300 to have an attorney prepare

- Flexible – You can change your mind anytime

Best For:

TOD designations work beautifully for homeowners who:

- Have relatively straightforward estates

- Primarily want to avoid probate for their home

- Don’t need comprehensive incapacity planning

- Want the most cost-effective solution

- Have financially responsible adult children

The Limitation:

A TOD only addresses your real estate. Your bank accounts, investments, vehicles, and other assets aren’t covered. Each will need its own planning (though many financial accounts allow you to name beneficiaries directly).

Option 2: Revocable Living Trust

A living trust is more comprehensive—and more complex—than a TOD, but for many families, it’s worth the extra investment.

How It Works:

You create a trust document and transfer your assets into it. You serve as the trustee, maintaining complete control during your lifetime. You name a successor trustee (often your child) to manage the trust when you pass away or if you become unable to manage your own affairs.

The trust owns your property, but you control the trust. When you die, your successor trustee distributes assets according to your instructions, all without going through probate.

The Benefits Beyond What a TOD Offers:

- Comprehensive coverage – Manages ALL your assets (real estate, bank accounts, investments, personal property), not just your home

- Incapacity planning – If you become unable to manage your affairs due to illness or injury, your successor trustee steps in immediately without needing court intervention

- Multi-state property – If you own properties in different states, a trust handles them all seamlessly (avoiding probate in each state)

- Privacy – Unlike probate (which is public) or a TOD (which becomes public record when filed), a trust remains private

- Control over distribution – You can specify exactly how and when beneficiaries receive assets (for example, distributing in stages or only for specific purposes)

- Asset protection for beneficiaries – You can include provisions that protect inherited assets from your children’s creditors, divorces, or poor financial decisions

- Special provisions – You can address concerns about spendthrift children, beneficiaries with special needs, or blended family situations

Best For:

A living trust makes sense for homeowners who:

- Have substantial assets beyond just their home

- Own multiple properties or properties in multiple states

- Want comprehensive incapacity planning

- Have concerns about how beneficiaries will manage their inheritance

- Value privacy

- Need to address complex family situations (second marriages, children with special needs, etc.)

- Want one comprehensive document managing everything

The Investment:

A complete estate plan with a living trust typically costs $1,500 to $3,500 or more, depending on complexity. Yes, it’s more expensive than a TOD, but for many families, the comprehensive benefits justify the investment.

Important Note About Funding Your Trust:

Creating the trust is only half the work. You must actually transfer your assets into the trust—called “funding the trust”—for it to work properly. Your attorney will help you with this process, which includes deeding your real estate to the trust and changing beneficiary designations on financial accounts.

Comparing Your Options Side by Side

| Feature | Adding Child to Deed | Transfer on Death | Living Trust |

|---|---|---|---|

| Avoid probate | Yes | Yes | Yes |

| You keep control | No | Yes | Yes |

| Stepped-up basis | No (major tax problem) | Yes | Yes |

| Protects from child’s creditors | No | Yes (during your life) | Yes |

| Covers all assets | No (just that property) | No (just real estate) | Yes |

| Incapacity planning | No | No | Yes |

| Privacy | No (public record) | No (public record) | Yes |

| Flexibility to change | Difficult (requires child’s consent) | Easy | Easy |

| Cost | Low initially, high tax cost later | $100-300 | $1,500-3,500+ |

What About Doing Nothing?

Some people wonder if they should just let their estate go through probate. After all, probate is a well-established legal process designed to transfer property after death.

Here’s my take: Probate in Ohio isn’t the nightmare it is in some states, but it’s still worth avoiding if you can do so easily.

Probate challenges include:

- Time (typically 6-12 months, sometimes longer)

- Cost (court fees, attorney fees, executor fees—typically 3-7% of the estate value)

- Public record (anyone can see what you owned and who inherited it)

- Stress for your family during an already difficult time

- Potential for family disputes to play out in court

Given that both TOD designations and trusts are relatively affordable ways to avoid probate while providing better outcomes for your family, I generally recommend one of these approaches for most homeowners.

Making the Right Choice for Your Family

So which option is right for you?

Choose a Transfer on Death designation if:

- Your home is your primary asset

- You have a relatively simple estate

- Your main goal is avoiding probate for your house

- You want the most affordable option

- Your children are financially stable adults

- You’re comfortable managing other assets separately

Choose a Living Trust if:

- You have significant assets beyond your home

- You own multiple properties, especially in different states

- You want comprehensive protection if you become incapacitated

- You have concerns about how your children will manage their inheritance

- You value privacy

- You have a complex family situation

- You want everything managed in one comprehensive document

Never add children directly to your deed if:

- Your goal is simply to avoid probate (both TOD and trusts accomplish this better)

- You want to maintain control of your property

- You want to minimize your children’s tax burden

- You want to protect your home from your children’s potential creditors or legal issues

Working With the Right Professionals

Estate planning isn’t something you should do alone. While this article gives you a framework for understanding your options, every family’s situation is unique.

Before making any decisions about your home and estate, work with:

An Estate Planning Attorney: They’ll help you understand Ohio law, draft the proper documents, and ensure everything is set up correctly. This isn’t the place to use online forms—the stakes are too high.

A Tax Advisor or CPA: They can help you understand the tax implications of different strategies for your specific situation and income level.

Your Real Estate Agent (that’s me!): While I can’t give legal or tax advice, I can help you understand the real estate implications of different planning strategies and connect you with trusted professionals.

Common Questions I Hear

“But my friend added her kids to the deed and it was fine.”

Maybe it was, or maybe the problems just haven’t shown up yet. The tax consequences don’t appear until your children sell the property. The creditor risks don’t matter until your child has a financial crisis. And the control issues don’t matter until you want to sell or refinance and discover you can’t without cooperation.

Just because something didn’t cause problems doesn’t mean it was the best choice.

“Isn’t this overthinking it? My parents just put everything in joint ownership and it worked out.”

Estate planning laws and tax rules have changed significantly over the years. Strategies that worked for previous generations may not be optimal today. The stepped-up basis rule is incredibly valuable—why throw that benefit away?

“What if I already added my child to the deed?”

It’s not too late to fix this, though it’s more complicated than doing it right from the start. Talk to an estate planning attorney about your options. You may be able to deed the property back to just yourself and then use a TOD or trust instead.

“Can I do a TOD and a trust?”

Generally, you’d choose one or the other. If you have a trust, your real estate should be deeded to the trust rather than using a TOD. The trust becomes your comprehensive solution.

Taking the Next Step

Estate planning isn’t the most exciting topic—I get it. But taking an afternoon to set this up correctly can save your family tens of thousands of dollars and untold stress.

If you’re a homeowner in Springboro, Beavercreek, Centerville, Kettering, or anywhere in the greater Dayton area, and you’re thinking about how your home fits into your estate plan, I’m here to help.

I work with families every day as they navigate these decisions, and I can connect you with trusted estate planning attorneys and financial advisors who can guide you through the process.

Your home is likely your most valuable asset. It deserves thoughtful planning that protects both you and your children.

Ready to talk about your estate planning options? Contact me today:

Claire Dunn

Coldwell Banker Heritage Realtors

(937) 369-4663

claire@clairedunnrealestate.com

Serving Springboro, Beavercreek, Centerville, Kettering, Bellbrook, Waynesville, and the greater Dayton area

Disclaimer: This article is for informational purposes only and does not constitute legal or tax advice. Every situation is unique. Please consult with a qualified estate planning attorney and tax advisor before making any decisions about your property or estate plan.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link